The interest rates below are applicable to these Multi-Currency Accounts: My Account/ DBS eMulti-Currency Autosave/ eMulti-Currency Autosave Plus/ Multi-Currency Autosave/ Multi-Currency Autosave Plus/ Expatriate eMulti-Currency Autosave/ Expatriate eMulti-Currency Autosave Plus account. Singapore Dollar (SGD) First $10, %. Next $90, % /6/15 · When you open a UOB multi-currency account and then apply for MightyFX, a set of 10 foreign currency accounts will be opened for you - and the MightyFX card linked to your account. Then, when you spend on your card, the payment will be debited directly from the relevant MightyFX foreign currency account Manage and perform transaction for up to 12 currencies with a single business bank account with DBS Corporate Multi-Currency Account (MCA). Learn more. If you open a Multi-Currency Account, an Indonesian Rupiah will be automatically added under this

Battle of the Multi-Currency Accounts & Travel Wallets: YouTrip, DBS MCA, UOB Mighty FX & Others

All opinions are those of The Milelion]. The MCA was launched earlier this yearoffering consumers the possibility of zero foreign currency transaction fees while enjoying the convenience of buying forex on-the-go. Of course, you first need to physically visit the moneychanger. Change too much and you either have to make a return trip to the moneychanger on the way back with the commensurate forex risk or tie up some of your money till your next trip. Otherwise, I still prefer to transact in cash so as to avoid fees.

The other issue that annoys me about overseas card transactions is refunds. Remember that your card uses a different buying and selling rate, so even if your transaction is refunded immediately you can still get hit. This was the case in the UK where an innkeeper mistakenly swiped my card for GBP54 instead of She refunded the wrong amount literally the next minute, but when I saw my statement the refund amount was less than the original amount debited.

I eventually got it sorted out with the bank but still…. Credit cards have a role to play in your overseas spending too, but only in certain circumstances i.

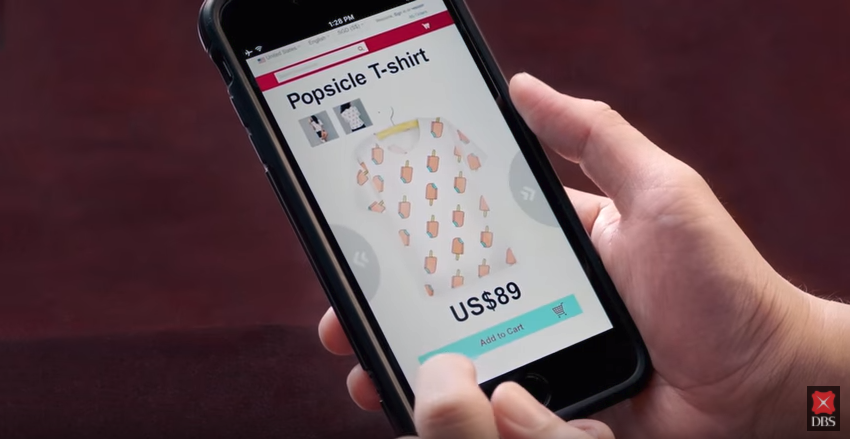

e 10X. This brings us to the MCA. How it works is simple: you open an account and tag your DBS Visa debit card to it. You then transfer your SGD into any of the 12 currencies supported. One important point- there are no foreign transaction fees when dbs multi currency account forex rates use your MCA, but you still need to be careful not to fall afoul of DCC.

I looked at the 12 currencies the MCA offers and was pleasantly surprised, dbs multi currency account forex rates. I threw in the rate at a good moneychanger at Arcade for comparison, dbs multi currency account forex rates. You can see that the spread between the MCA and a moneychanger is marginal. In fact, there are some currencies NZD, NOK, SEK where the MCA offers better rates than a moneychanger.

You could view that as the convenience fee for exchanging money on the go. I think the DBS MCA can play a useful role in a foreign spending strategy. However, the bulk of my general spending would go through my MCA-linked debit card. If this sounds like the option for you, have a read of this post that walks you through how to use the DBS MCA. Purchases made through any of the links in this article may generate an affiliate commission that supports the running of the dbs multi currency account forex rates. Found this post useful?

Subscribe to our Telegram Channel to get these posts pushed directly to your phone, or our newsletter via the home page. banking dbs featured mca overseas Aaron Wong Aaron founded The Milelion with the intention of helping people travel better for less and impressing chiobu.

Can the MCA linked debit card be used as ATM card for overseas withdrawal without being hit by overseas withdrawal fees? Some points: 1. Forex rate charged by DBS is still nowhere near as competitive as the moneychangers in Change Alley. Transfer too much into the forex account means you will have to transfer it back dbs multi currency account forex rates SGD and lose from the spread in the exchange rates. For those of us who collect miles, this is definitely not better when you can earn 4 mpd.

oh, and how could i forget uob visa signature. Just a little note when using the MCA to draw money from ATM overseas. If it is not the primary account, the ATM might will withdraw from your primary account which is likely an SGD account. I settled to have two accounts and two cards — one account — for local usage and its own card. Second account — almost no SGD inside and has its own card while refilled with the destination currency before travel.

for cny, can we withdraw cash from foreign atms using the mca linked atm card? any charges involved? There is a better card for general spend if your goal is to minimize transaction costs.

The ICBC Global Travel Mastercard. There is the obligatory 2. The 0. Other weaknesses of MCA: — You … Read more », dbs multi currency account forex rates. Aaron makes it clear upfront the post is sponsored. The MCA is not a bad choice for many of the reasons laid out in the post.

I had seriously considered it when it came out. There are definitely credit cards out there that can be useful for overseas purchases thanks to rebates on forex fees eg ICBC. FYI there is also the citibank debit mastercard that is functionally … Read more ». There is definitely a niche this product appeals to. Interesting one. Yes, but you also get 1. It is not a card for the 10x categories. You need a dbs multi currency account forex rates high ADB.

Also since the DBS interest rate is pathetic; this might not work out so well. MCA can hold SGD. Just to add, the DBS Multiplier account also functions as an MCA account, which might allay some concerns regarding low interest rates.

However, where only general spending 2mpd type rates exist, the proposition is much more marginal, dbs multi currency account forex rates. I disagree. I think you are overstating the cost of using a credit card for foreign currency charges.

I do travel a fair bit for work and … Read more ». the more i think about it, the more i agree, dbs multi currency account forex rates. So yes, the implication is that the cost of buying miles through this method decreases. where i see MCA fitting in for me is in place of those cash transactions, dbs multi currency account forex rates.

and again, this … Read more ». So as long as you are still buying miles, be it from paying annual fees, or taking … Read more ». For me, besides buying miles outright from Lifemiles, AA, OCBC Voyage etc, overseas personal expenditure using credit cards is the next most important source of miles, at under SGD0. you get charged to deposit cash notes of foreign ccy i believe, so cannot go to the arcade then deposit at bank. i use a money transfer company like WorldFirst to dbs multi currency account forex rates my ccy.

I would use WorldFirst to fund these MCAs. Once upon a time, DBS MCA was a low key account that did not charge fees for FCY deposit and withdrawal at least not for USD. I remember someone in my office mentioning long lines to get USD cash out in DBS when they announced the change. The newly launched […].

Hotels Best Rate Guarantees BRGs for beginners Singapore Staycation Guide Trip Reports Trip Report Index Events. THE MILELION, dbs multi currency account forex rates.

All Topics. Credit Cards. Sign in. your username. your password. Forgot your password? Get help. Password recovery. your email. Home Banking. How the DBS Multi-Currency Account can be a smarter way of spending overseas.

Aaron Wong. Nov 7, Are you willing to give up points for competitive forex rates and no foreign transaction fees? All opinions are those of The Milelion] Deciding what method of payment to use when overseas is always a tricky question for me. banking dbs featured mca overseas. Aaron Wong Aaron founded The Milelion with the intention of helping people travel better for less and impressing chiobu.

Previous article Getting started with your DBS Multi-Currency Account. Similar Articles. Notify of. new follow-up comments new replies to my comments. Oldest Newest. Inline Feedbacks.

DBS - Say Goodbye To Foreign Currency Notes!

, time: 1:21How the DBS Multi-Currency Account can be a smarter way of spending overseas | The Milelion

Nov 06, · If you’re depositing foreign currency (e.g. AUD) into a fresh AUD wallet like I just did, you’ll need to pay an a/c starting fee (% varies by country) and for me it was a painful % for AUD with DBS e-MultiCurrency blogger.comted Reading Time: 4 mins Reduce the cost of international trade & hedge against forex fluctuations with the DBS Exchange Earner's Foreign Currency Account. Apply for a new account now. 2 Part conversions are permissible from the EEFC to INR depending on the requirement subject to /10/15 · The DBS Multi-Currency Account lets you stash cash in up to 12 foreign currencies as well as the Singapore dollar. There are a few types of DBS MCA, but the most popular one is the Multiplier account as it allows you to save SGD for your personal savings and gives you bonus interest for crediting salary and spending with a DBS credit card

No comments:

Post a Comment