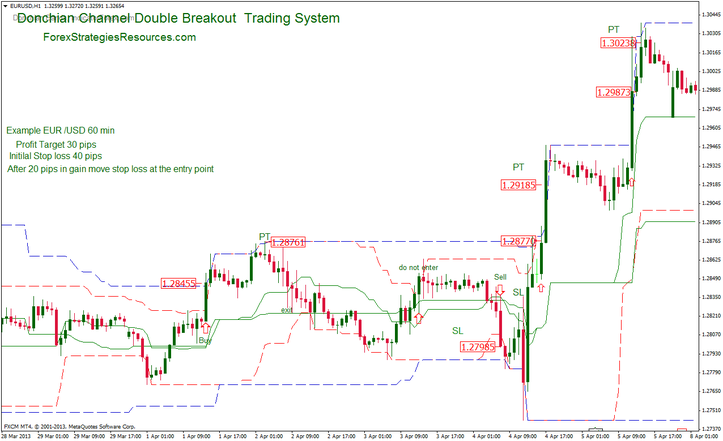

May 28, · I look at the height of the Donchian channel. In this case it compressesthe price within the range and which is our stop loss as well. A market order above , say 5 - 10 pips. ATR tells me if it has compressed enough to be a trade break out. If the channel is less than 3 times the ATR then it's compressed. That's it. Simple Fig. Free Download. Download the Donchian Channel Breakout Forex Trading Strategy. About The Trading Indicators. The blogger.com4 indicator for MetaTrader4 is an enhanced Donchian Channel deployed to spot price breakouts below or above recent price blogger.comted Reading Time: 3 mins Apr 05, · Double Channel Trading Strategy. Another common way is to combine the Donchian blogger.com is a strategy that is similar to a double moving averages strategy. The idea is to have two DC indicator with different blogger.com can have one with the 20 default option and another one with a shorter option like Estimated Reading Time: 4 mins

Donchian Breakout Strategy by millerrh — TradingView

Donchian Channels is a technical indicator designed by Richard Donchian, a pioneer in futures trading. This indicator is similar to the Bollinger Bands and analyzes the evolution of the price by plotting the highest high and lowest low over a specific time interval.

The Donchian channels indicator is represented graphically by three lines, one being the average calculated according to the preferred setting 20 or 55, etc.

Donchian Channels is a useful indicator for measuring volatility in a market. Donchian channel breakout forex trading strategy Donchian developed this indicator in an attempt to develop a mechanical trend trading system for futures trading that would keep the trader on the right side of any trend. This may seem a little confusing if you are familiar with Bollinger Bands. Many traders assume that a breakout above upper or lower Donchian Channels signals an overbought or oversold area and a reversal could be on the cards, donchian channel breakout forex trading strategy.

This assumption is wrong, trading with Donchian Channels is similar to support and resistance trading. Conversely, if the market momentum breaks below the Donchian Lower Channel, a new downtrend could be developing. Just like in the support and resistance case, once a support level is brokenthe level becomes a resistance level and once a resistance level is broken becomes a support level. The Donchian Channels is a great indicator to identify dynamic support and resistance levels during market trends.

Most support and resistance levels, like market highs and lows, pivot points, round numbers etc. are static levels. Well, Donchian channels offer traders dynamic areas of support and resistance because are constantly changing depending on recent price action.

As we previously explained, Donchian Channels is a useful indicator for measuring volatility in a market. It has almost the same characteristics as the Bollinger Bands. Bollinger Bands is also an indicator that detects the volatility and dynamics of the price on the market. As in the case of Donchian Channels, the Bollinger Bands contract when the market volatility is low and expand when volatility increases.

During periods of low volatility, the bands are narrow, while during periods of high volatility Bollinger Bands expand drastically. Many traders like to compare these two indicators, to determine which one works best in certain market conditions. Of course, each of the indicators has its own advantages and limitations.

I prefer not to compare the indicators, but to use them both in the same trading system. Both indicators will track the market volatility, and at the same time will offer dynamic areas of support and resistance. So, if a standard deviation of 3. We plotted the Bollinger Bands and the Donchian Channels and we look at the range of the bands and at their position.

Many traders will avoid trading in this scenario, donchian channel breakout forex trading strategy to me, donchian channel breakout forex trading strategy, this represents a low-risk opportunity to trade around the support and resistance of the range. We identified that the Donchian Channels are inside the Bollinger Bands, parallel and in a trading range. We determined the previous support and resistance levels and we waited for the price action to trade around those levels.

The first signal was a strong buy signal, as the price touched the lower Bollinger Band and the lower Donchian channel, donchian channel breakout forex trading strategy. This area coincided with the previous support level. As you can see, the price rose all the way to the uppers side of the range. At the upper side, we had 2 sell signals, around the Donchian Upper Channel and the previous resistance area.

As we anticipated, the price was unable to continue its upward direction and started to go south once again. This time, the price was unable to reach the lower side of the range, stopping donchian channel breakout forex trading strategy the lower Donchian channel.

Thus, we were unable to enter the market once again of the upside swing. For example, you could add a long-term moving average, like the exponential moving average, and take only long positions above the EMA or short positions below the EMA.

Many traders prefer to identify a breakout and ride the momentum that comes with it. Donchian Channels and Bollinger Bands can also assist investors in taking these breakout trades.

The principles mentioned for the low volatility scenario remain the same. You just have to wait for a breakout to occur in any side of the channel. As the price retested the former area of support, this represented a good short signal, the price being near the upper side of the Donchian Channels, donchian channel breakout forex trading strategy. We identified a clear trading range, during a period of low volatility, with the Donchian Channels inside the Bollinger Bands.

As the price closed below the range, the Bollinger Bands and the Donchian Channels started to expand. During a strong uptrend, the price often retraces to the middle Bollinger Band and continues its initial direction. The idea behind this technique is that an overextended market will eventually reverse inside the bands.

At this point, it is often possible to enter a trade in the direction of the original band touch. We must donchian channel breakout forex trading strategy this signal with other indicators. I donchian channel breakout forex trading strategy to use the static support and resistance levels — relevant market highs and lows, pivot points or Fibonacci retracements.

The conditions for determining a strong upward trend are met, with the Donchian Channels trend channel indicator inside the middle and upper Bollinger Bands. We wait for the price to retrace around the middle Bollinger Bands, donchian channel breakout forex trading strategy.

This area coincides with the On top of that, we also had the lower Donchian Channel around that area. As you can see, 3 support forces are located around the same area, determining the price to continue its upward direction.

The conditions for spotting a strong downward trend are met, with the Donchian Channels inside the middle and lower Bollinger Bands. This area coincides with the 50 Fibonacci retracement level, drawn from the previous market swing. Around that area, we also had the upper Donchian Channel. So, the 50 Fibonacci retracement level, the middle Bollinger Band and the Upper Donchian Channel acted a strong resistance area and determined the price to continue its initial downward direction.

On Balance Volume OBV is a momentum indicator that relates volume to price change. The main assumption is that On Balance Volume movements precede price changes.

OBV is a leading indicator and works excellent with Donchian Channels. Let me explain how we can use this two indicators to complement each other and generate quality signals. We can clearly see that the OBV is well above the exponential moving averages, indicating a strong upward trend. As we are in an uptrend, we look to buy at the lower Donchian Channels.

As the price trades near or touches the lower Donchian Channel, we can enter long on the market. In the perfect scenario, we should wait for the price to touch the Donchian Channel trend channel indicatorbut in most cases, the price movement will stop a few pips above the targeted area, donchian channel breakout forex trading strategy. Markets are not perfect, so it all depends on your style to enter the market.

Above we have another chart, this time with short entries. We can observe that the OBV is well below the exponential moving averages, indicating a strong downward trend. As we are in a donwtrend, we look to sell at the upper side of the Donchian Channels. As the price trades near or touches the upper Donchian Channel, we can open short positions on the market. As you can see, in a strong trend, the on-balance volume as a leading indicator and the Donchian Channels form a great partnership.

Of course, you could add other filters to confirm the market entries, but I like to keep it simple and use just the 2 indicators.

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. com and all individuals affiliated with this website assume no responsibilities for your trading and investment results. The indicators, strategies, articles and all other features are for educational purposes only and should not be construed as investment advice.

Please keep in mind that we may receive commissions when you click our links and make purchases. We only promote those products or services that we have investigated and truly feel deliver value to you. Copyright The Secret Mindset © All rights reserved, donchian channel breakout forex trading strategy. Donchian Channels Trading Strategy: Day Trading Breakouts.

Share on facebook. Share on twitter. Share on linkedin. Share on whatsapp. Share on reddit. Table of Contents. SHARE THIS POST. Sophisticated software that scans through all the charts, on all time frames and analyzes every potential breakout, with high accuracy.

Try Forex trendy. An easy-to-use software platform that allows you to scan market data, identifying historical trends and market cycles that match your search criteria. Test Trademiner.

Leave a Comment Cancel reply Comment Name Email Website. trade like a professional Learn to identify high-potential trades and increase consistency of returns using key levels and no lagging indicators.

Discover More. Start Trading With Our 1 Broker Recommendation 5-Star Rating on Forex Peace Army. Visit BlackBull Markets. related posts. Hidden Divergence Trading Strategy: Day Trading Tips. Stochastic Oscillator Trading Strategy: Day Trading Tips, donchian channel breakout forex trading strategy.

Richard - Donchian Channel Indicator with trading strategy -- Intraday, Short Term ������

, time: 14:53Donchian Channel Strategy: Identify Breakouts and Reversals! - DTTW™

Nov 16, · Code the Donchian Channel Breakout trading strategy for TradingView. Step 1: Define strategy settings and input options. Step 2: Calculate trading strategy values. Step 3: Output the strategy's data. Step 4: Determine the trading conditions. Step 5: Open a trading Estimated Reading Time: 8 mins Dec 31, · Donchian Breakout Strategy. This strategy buys when the Donchian Channel is broken to the upside and uses the lower Donchian Channel line as a trailing stop. You can also choose to use a moving average as a filter to keep you out of trades that are counter trend. You can also configure which dates you want to backtest, so you can see how this Sep 21, · Breakout indicator. Donchian channels are mainly used to identify the breakout of a stock or any traded entity enabling traders to take either long or short positions. Traders can take a long position, if the stock is trading higher than the Donchian channels “n” period and book their profits/short the stock if it is trading below the DC channels “n” blogger.comted Reading Time: 8 mins

No comments:

Post a Comment