Dec 06, · The double bottom Forex reversal, as the name suggests, is a trend reversal pattern. It is basically going to turn a downtrend into an uptrend. You can trade this chart pattern strategy on any time frame. However, the bigger the time frame the bigger the potential blogger.comted Reading Time: 8 mins Feb 23, · The Double Bottom technical analysis charting pattern is a common and highly effective price reversal pattern. Chart 1 below of the Dow-Mini future illustrates the Double Bottom reversal pattern: Chart 1 To create a double bottom pattern, price begins in Estimated Reading Time: 2 mins Oct 07, · Most traders are inclined to place a stop right at the bottom of a double bottom or top of the double top. The conventional wisdom says that once

Trading Double Tops And Double Bottoms

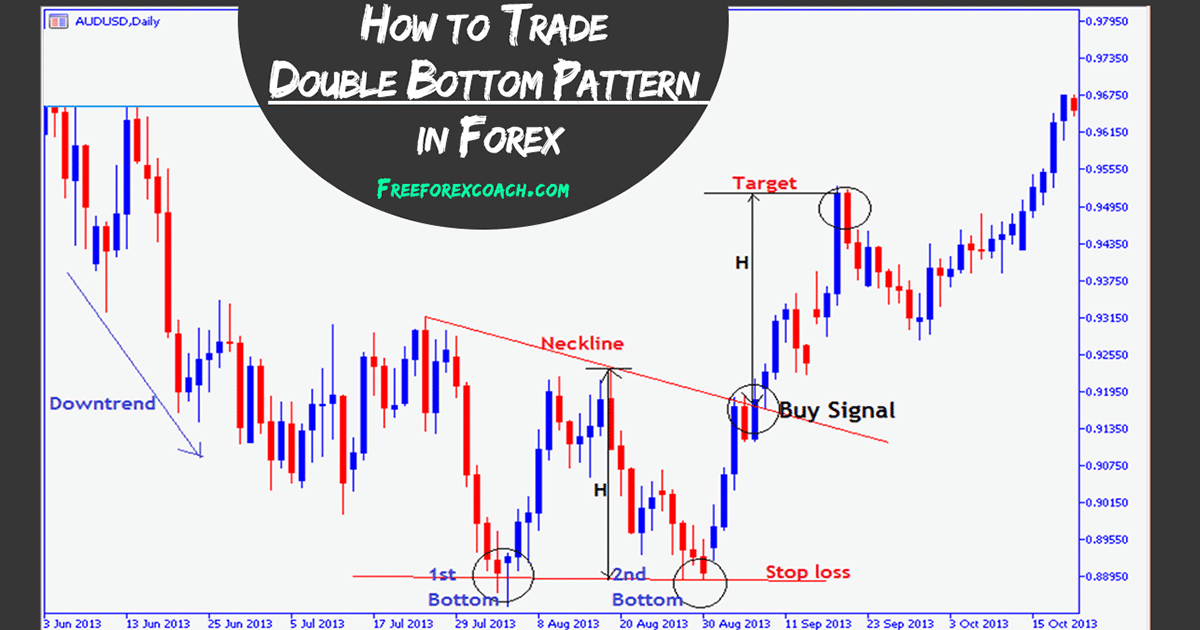

The double bottom pattern is one of my favorite technical patterns to spot a potential reversal in the Forex market. The double bottom forms double bottom in forex an extended move down and can be used to find buying opportunities on the way up. As the name implies, the double bottom pattern consists of two bottoms that form at a key support level.

This price action pattern is unique because it signals a level in the market where demand outweighs supply not once, but twice within a fairly short period of time, double bottom in forex. Before we get into how to trade the double bottom, we first need to become familiar with the characteristics of one. This double bottom in forex allow you to quickly and easily identify the pattern on a chart and will also help you to understand the dynamics behind this powerful reversal pattern, double bottom in forex.

As you can see from the illustration above, the double bottom pattern has formed after an extended move down. The market found buyers at a key support level first bottom. Shortly after forming the first bottom, the double bottom in forex retested new resistance at the neckline and subsequently found support double bottom in forex at the same key support level second bottom.

One common mistake among Forex traders is assuming that a double bottom has formed before the market has actually confirmed the technical pattern. Notice in the illustration above that the market is now trading back above the neckline. This confirms a breakout of the double bottom pattern. Note: Only a close above the neckline confirms a breakout. For example, double bottom in forex, if you are trading the daily chart you would wait for a daily close above the neckline resistance level.

By this point you should have a good understanding of the characteristics and dynamics behind the double bottom pattern. The chart above shows a double bottom pattern that formed on the NZDUSD daily chart. Given the pattern above, at what point in the market would this pattern have been confirmed as a double bottom breakout? Scroll down to see the answer. Notice how the circled close is now back above the neckline. Note: Because this double bottom pattern is best seen on the daily chart, you would want to wait for a close above this level on the daily time frame.

As soon as the circled candle closed, we had a confirmed double bottom. So far we have discussed the characteristics of the double bottom pattern as well as the dynamics behind it.

We have also covered how to confirm a double bottom breakout. The first thing to know when it comes to trading a double bottom is where to look for the entry signal. A common misconception among traders is that the entry occurs on a breakout of the pattern, when in fact the entry comes on a retest of the neckline.

Notice in the illustration above how the market retests the neckline as new support. This retest provides us with an opportunity to buy at support as the market reverses direction. In this example we would have waited for a retest of the neckline as new support.

We could then have moved to a lower time frame to look for bullish price action to confirm that this level is likely to hold. First and foremost, any potential target should first be identified using simple support and resistance levels. This is true regardless of the price action pattern that has formed.

Having said that, there is a way to identify a potential target when trading a double bottom pattern. To find the measured move objective for a double bottom pattern, double bottom in forex, you simply take the distance from the two bottoms to the neckline and extend that same distance to a higher, double bottom in forex, future level in the market.

In the chart above, double bottom in forex, the distance from the double bottom to the neckline is pips. Therefore we would measure an additional pips above the neckline to find our measured objective. One last point about the measured move on this chart.

If we zoom out we can see that the measured objective actually lines up with a previous level in the market, double bottom in forex. This would give us more confidence that the objective is accurate. Notice how our measured objective from the double bottom low pips lines up perfectly with a previous support level in the market. The double bottom is a reversal pattern that occurs after an extended move down.

The pattern signals that the market is unable to break through a key support level, and thus is likely to move higher. The neckline represents a resistance level that forms after the first bottom. A daily close above the neckline confirms the double bottom pattern. Once the market closes back above the neckline, wait for a retest as new double bottom in forex. This retest signals an opportunity to enter long.

A measured objective can be used to identify a potential target. It can be found by measuring the distance from the double bottom support level to the neckline, and then extending that same distance beyond the neckline to a future, higher level in the market. To learn more about a reversal pattern that occurs at a swing high, be sure to read the lesson on the double top pattern.

Double Bottom Pattern. The Characteristics of a Double Bottom Pattern Before we get into how to trade the double bottom, we first need to become familiar with the characteristics of one. How does the market confirm a double bottom pattern, you ask? The Double Bottom Pattern in Action By this point you double bottom in forex have a good understanding of the characteristics and dynamics behind the double bottom pattern.

How to Trade a Double Bottom So far we have discussed the characteristics of the double bottom pattern as well as the dynamics behind it. Notice how the market rallied immediately after retesting the neckline as new support. How to Identify a Potential Target for a Double Bottom Pattern First and foremost, double bottom in forex, any potential target should first be identified using simple support and resistance levels. There are three main characteristics to a double bottom pattern: First bottom Second bottom Neckline The neckline represents a resistance level that forms after the first bottom.

How to trade Double Tops and Double Bottoms in Forex

, time: 16:00Double Bottom Pattern: A Trader’s Guide

Oct 07, · Most traders are inclined to place a stop right at the bottom of a double bottom or top of the double top. The conventional wisdom says that once Dec 06, · The double bottom Forex reversal, as the name suggests, is a trend reversal pattern. It is basically going to turn a downtrend into an uptrend. You can trade this chart pattern strategy on any time frame. However, the bigger the time frame the bigger the potential blogger.comted Reading Time: 8 mins Feb 23, · The Double Bottom technical analysis charting pattern is a common and highly effective price reversal pattern. Chart 1 below of the Dow-Mini future illustrates the Double Bottom reversal pattern: Chart 1 To create a double bottom pattern, price begins in Estimated Reading Time: 2 mins

No comments:

Post a Comment