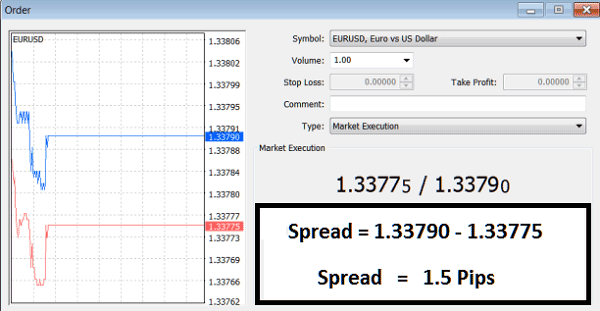

In all cases, forex quotes have both the bid price and the ask price of a currency pair. Since the spread is the difference between the two, finding out the exact size of the spread is just a matter of calculation. For example, if GBP/USD is listed with a bid price of and an ask price of , the spread is 7 pips Factors that can influence the forex spread include market volatility, which can cause fluctuation. Major economic indicators, for example, can cause a currency pair to strengthen or weaken – thus affecting the spread. If the market is volatile, currency pairs can incur gapping, or the currency pair becomes less liquid, so the spread will widen Jul 25, · The forex spread is the difference between a forex broker's sell rate and buy rate when exchanging or trading currencies. How Forex Spreads Are Quoted. Below is an example of how a

Spread in Forex Trading: Calculation & Strategy | CMC Markets

John Russell is an experienced web developer who has written about domestic and foreign markets and forex trading for The Balance. He has a background in management consulting, database and administration, and website planning. Today, he is the owner and lead developer of development agency JS Web Solutions, which provides custom web design and web hosting for small businesses and professionals. To better understand the forex spread and how it affects you, you must understand the general structure of any forex trade.

One way of looking at the trade example of spread in forex is that all trades are conducted through intermediaries who charge for their services. This charge—which is the trade's difference between the example of spread in forex and the asking price—is called the spread. The forex spread represents two prices: the buying bid price for a given currency pair, and the selling ask price. Traders pay example of spread in forex certain price to buy the currency and have to sell it for less if they want to sell back it right away.

For a simple analogy, consider that when you purchase a brand-new car, you pay the market price for it. The minute you drive it off the lot, the car depreciates, and if you wanted to turn around and sell it right back to the dealer, you would have to take less money for it.

Depreciation accounts for the difference in the car example, example of spread in forex, while the dealer's profit accounts for the difference in a forex trade.

The forex market differs from the New York Stock Exchangewhere trading historically took place in a physical space. The forex market has always been virtual and functions more like the over-the-counter market for smaller stocks, where trades are facilitated by specialists called market makers.

The buyer may be in London, and the seller may be in Tokyo—an intermediary is needed to coordinate the transaction.

The specialist, one of several who facilitates a particular currency trade, may even be in a third city. His responsibilities are to assure an orderly flow of buy and sell orders for those currencies, which involves finding a seller for every buyer and vice versa.

In practice, the specialist's work involves some degree of risk. It can happen, for example, that they accept a bid or buy order at a given price, but before finding a seller, the currency's value increases. The specialist is still responsible for filling the accepted buy order and may have to accept a higher sell order than the buy order they have committed to filling. In most cases, the change in value will be slight, and the market maker will still make a profit.

As a result of accepting the risk and facilitating the trade, the market maker retains a part of every trade, example of spread in forex. The portion they keep is called the spread. Every forex trade involves two currencies called a currency pair. This example uses the British Pound GBP and the U, example of spread in forex. Say that, at a given time, the GBP is worth 1. The asking price for the currency pair won't exactly be 1. It will be a little more, perhaps 1.

Meanwhile, the seller on the other side of the trade won't receive the full 1. They will get a little less, perhaps 1. The difference between the bid and ask prices—in this instance, 0. The spread may not seem like much, but.

The facilitator can assist in thousands of these trades per day. Using the example above, the spread of 0. Currency trades in forex typically involve larger amounts of money. The 0. You have two ways of minimizing the cost of these spreads:. Trade only during the most favorable trading hourswhen many buyers and sellers are in the market. As the number of buyers and sellers for a given currency pair increases, competition and demand for the business increase, and market makers often narrow their spreads to capture it.

Avoid buying or selling thinly traded currencies. If you trade a thinly traded currency pair, there may be only a few market makers to accept the trade. Reflecting on the lessened competition, they will maintain a wider spread. Trading Forex Trading. By Full Bio Follow Linkedin. Follow Twitter, example of spread in forex. Read The Balance's editorial policies. Reviewed by. Full Bio Follow Linkedin.

Somer G. Anderson is an Accounting and Finance Professor with a passion for increasing the financial literacy of American consumers. She has been working in the Accounting and Finance industries for over 20 years. Article Reviewed on June 23, Read The Balance's Financial Review Board. Key Takeaways The spread is the difference between the buying and selling price of a currency pair.

Forex spread is determined when a facilitator finds a buyer and seller for a pair example of spread in forex adjusts the price slightly on each side. The spread is a transaction fee paid to the facilitator for their services—spread is often lower at busy trading times.

Warning! Market Spread Affects Trade Entry \u0026 Exits. Learn To Setup Trades Correctly.

, time: 19:23How to Understand the Forex Spread

Jul 25, · The forex spread is the difference between a forex broker's sell rate and buy rate when exchanging or trading currencies. How Forex Spreads Are Quoted. Below is an example of how a Factors that can influence the forex spread include market volatility, which can cause fluctuation. Major economic indicators, for example, can cause a currency pair to strengthen or weaken – thus affecting the spread. If the market is volatile, currency pairs can incur gapping, or the currency pair becomes less liquid, so the spread will widen Jun 23, · The Cost of the Spread Using the example above, the spread of British Pound (GBP) doesn't sound like much, but even a tiny spread quickly adds up as a trade gets larger. Currency trades in forex typically involve larger amounts of money. As a retail trader, you may be trading only one 10,unit lot of GBP/blogger.comted Reading Time: 4 mins

No comments:

Post a Comment