6/3/ · Within a Fibonacci Forex trading strategy, traders can go one step further and add in more technical analysis to help confirm whether the market will actually turn or not. One of the most popular confirmation tools that can help identify whether the price of a market Estimated Reading Time: 9 mins 1/14/ · A Fibonacci Forex retracement, in general, is a short term price correction during an overall larger upward or downward movement. These price corrections are temporary price reversals and don’t indicate a change in the direction of the larger trend. Finding and trading retracements is a method of technical analysis used for short-term trades 2/21/ · #1 Fibonacci Sequence in the Forex Market The sequence of numbers starts from zero and one, and then the next number comes with the addition of the previous two numbers. For example, the beginning of the sequence is 0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55,

How To Use Fibonacci To Trade Forex

We use a range of cookies to give you the best possible browsing experience. By continuing to use this website, you agree to our use of cookies. You can learn more about our cookie policy hereor by following the link at the bottom of any page on our site. See our updated Privacy Policy here. Note: Low and High figures are for the trading day. Forex traders utilize Fibonacci retracements to aid in identifying possible key levels of support and resistance. These levels are used as guidelines for traders looking to enter or exit the market along with appropriate risk management techniques.

This starts by identifying the trend; this can be long, medium or short-term depending on trading style. There are various methods that can be used to identify the trend such as simple price actionindicators like Moving Averages MAas well as other methods.

The reason why identifying the trend is important is because the Fibonacci tool itself does not determine a fibonacci on forex markets bias, rather it identifies key support and resistance levels. Further your knowledge on trend trading. This will produce key levels using Fibonacci metrics. The dueling nature of a forex pair has the tendency for mean reversion, which can produce major moves from which Fibonacci retracements can be drawn.

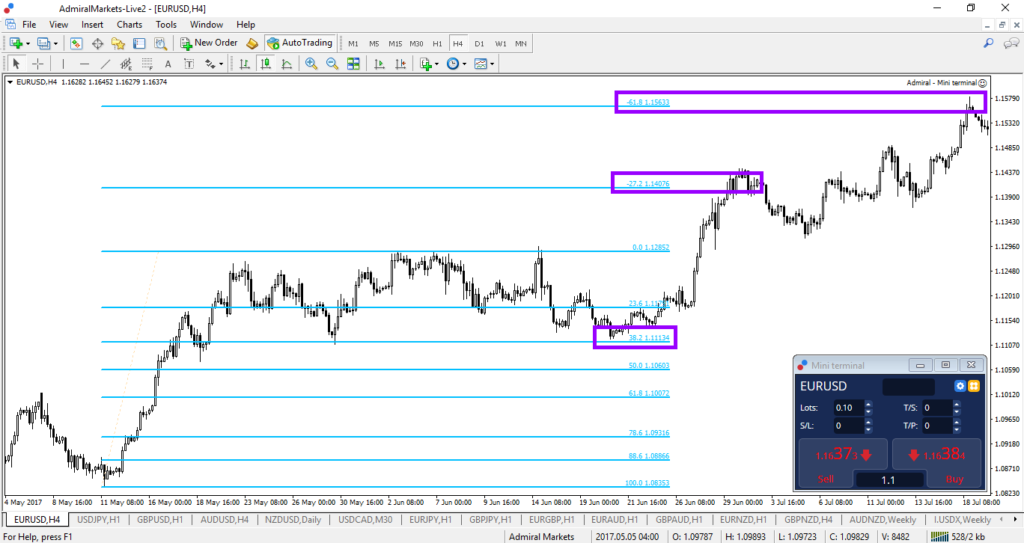

The key levels to look out for are the This level simply marks half the market move between the initial high and low or vice versa. Highlighted in black are the respective low to high points which are used to plot the Fibonacci levels. Chart prepared by Warren VenketasIG. Chart prepared by Warren VenketasIG charts. Once the Fibonacci retracement is drawn, traders can use these price levels for possible entry and exit signals. The blue fibonacci on forex markets highlights the area between the It is evident that price respects these two key support and resistance points.

Traders may look to enter into short positions at the It is important to note that the Fibonacci points should not be seen as concrete levels but rather guidelines or reference points.

Price will not always trade at these exact levels. It is common to see price just falling short or pushing passed a level which fibonacci on forex markets frustrate traders who look at exact levels. With reference to stop and limit orders, traders should give themselves some leeway for potential price fluctuations around the Fibonacci level. The chart below shows an example of this above the Chart prepared by Warren VenketasIG Charts.

This is the most simplistic form of the Fibonacci retracement within forex markets. The versatility of the Fibonacci retracement function means that it is not limited to one time frame as seen above.

A more complicated approach involves several Fibonacci retracements across different time frames, fibonacci on forex markets. Instituting multiple time frame fibonacci on forex markets can allow for multiple Fibonacci retracements drawn from major moves.

The next article in the Fibonacci series will go into more depth with and practical examples to show how exactly traders can implement this strategy. Forex traders often make the mistake of relying solely on Fibonacci levels to take positions in the market but this can be detrimental as this can make them too one dimensional. Additional support from other indicators, chart patterns, candlestick patterns and fundamentals are essential to formulate a better overall strategy; and ultimately a well-informed trade decision.

The Fibonacci can be an extremely powerful tool in forex trading so fully understanding its foundations can be beneficial to any trader looking to implement the tool within their trading strategy.

To sign up for a demo account with IG Group, please click here. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets, fibonacci on forex markets. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors, fibonacci on forex markets.

We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. Forex trading involves risk.

Losses can exceed deposits. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. FX Publications Inc fibonacci on forex markets DailyFX is registered with the Commodities Futures Trading Commission as a Guaranteed Introducing Broker and is a member of the National Futures Association ID Registered Address: 32 Old Slip, Suite ; New York, NY FX Publications Inc is a subsidiary of IG US Holdings, Inc a company registered in Delaware under number Sign up now to get the information you need!

Receive the best-curated content by our editors for the week ahead. By pressing 'Subscribe' you consent to receive newsletters which may contain promotional content. For more info on how we might use your data, see our privacy notice and access policy and privacy website.

Check your email for further instructions. Live Webinar Live Webinar Events 0, fibonacci on forex markets. Economic Calendar Economic Calendar Events 0.

Duration: min. P: Fibonacci on forex markets. Search Clear Search results. No entries matching your query were found. English Français 中文(繁體) 中文(简体). Free Trading Guides. Please try again. Subscribe to Our Newsletter.

Market Overview Real-Time News Forecasts Market Outlook Market News Headlines. Rates Live Chart Asset classes. Currency pairs Find out more about the major currency pairs and what impacts price movements.

Commodities Fibonacci on forex markets guide explores the most traded commodities worldwide and how to start trading them.

Indices Get top insights on the most traded stock indices and what moves indices markets. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. Economic Calendar Central Bank Calendar Economic Calendar. Unemployment Rate Q1. Nationwide Housing Prices YoY JUN. F: P: R: Consumer Confidence JUN. Trading courses Forex for Beginners Forex Trading Basics Learn Technical Analysis Volatility Free Trading Guides Live Webinars Trading Research Trading Guides.

Company Authors Contact. of clients are net long. of clients are net short. Long Short. Oil - US Crude. Wall Street, fibonacci on forex markets. As a New Retail Trader Age Rises, Heed Tales of Past Manias Gold Price Susceptible to NFP Report amid Looming Fed Exit Strategy More View more. Previous Article Next Article. Fibonacci in the Forex Market Warren Venketasfibonacci on forex markets, Markets Writer.

Fibonacci in the Forex Market Forex traders utilize Fibonacci retracements to aid in identifying possible key levels of support and resistance, fibonacci on forex markets.

Recommended by Warren Venketas. Forex for Beginners. Get My Guide. Introduction to Technical Analysis 1, fibonacci on forex markets.

Learn Technical Analysis. Technical Analysis Tools. Time Frame Analysis. Market Sentiment. Candlestick Patterns. Support and Resistance. Trade the News. Technical Analysis Chart Patterns. html'; this.

How to Trade With Fibonacci Retracement - Step-By-Step Guide

, time: 17:48Fibonacci in the Forex Market

6/3/ · Within a Fibonacci Forex trading strategy, traders can go one step further and add in more technical analysis to help confirm whether the market will actually turn or not. One of the most popular confirmation tools that can help identify whether the price of a market Estimated Reading Time: 9 mins 2/21/ · #1 Fibonacci Sequence in the Forex Market The sequence of numbers starts from zero and one, and then the next number comes with the addition of the previous two numbers. For example, the beginning of the sequence is 0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 10/19/ · Fibonacci in the Forex Market Forex traders utilize Fibonacci retracements to aid in identifying possible key levels of support and resistance. These levels are used as guidelines for traders

No comments:

Post a Comment