Order flow in the forex market is driven by trades that flow through large financial institutions where counterparties range from other sell side players, to buy side customers which include both treasuries, central banks and portfolio managers. The orders that sell side players receive from customers relay important blogger.comted Reading Time: 10 mins /10/31 · For doing a correct order flow analysis of the forex markets you have to use the real stock exchange data. Volumen and order flow which is provided by Forex Brokers is useless because it is depending on the liquidity provider. By using the volume of futures you get real data that is moving the markets Many traders are interested to trade forex with Order Flow. It is possible to do but you need some knowledge about it. The biggest forex market is the spot forex markets (interbank market) where the most forex traders are trading. You can not use Order Flow by the spot market because each broker and bank have different blogger.comted Reading Time: 8 mins

Order Flow Trading Strategy for Forex and Stock Markets - With Free PDF

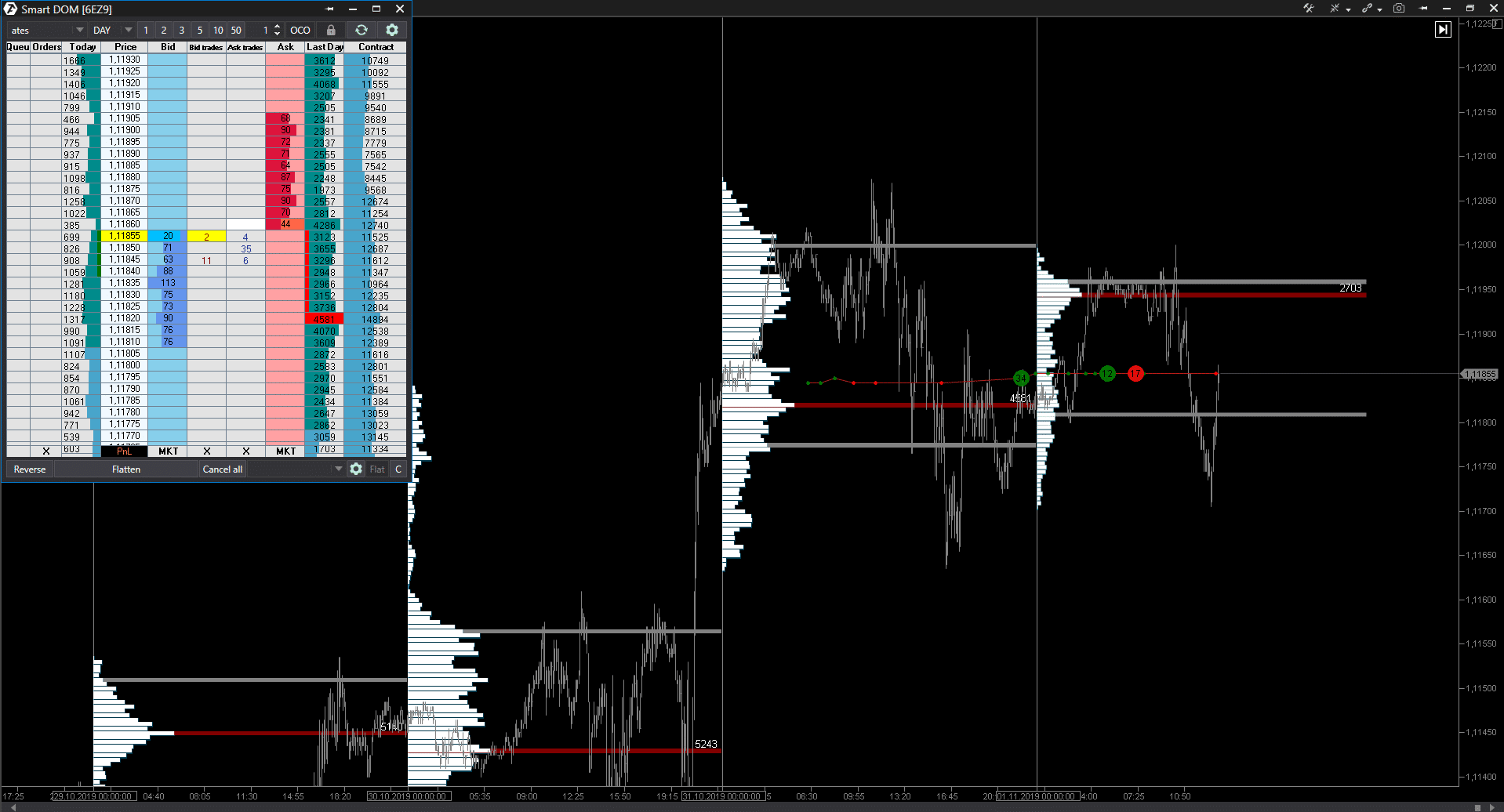

The goal of an order flow trader is to make predictions about the future market price by thinking about how and when orders are going to come into the market from traders making decisions. This is primarily done via guess-work and from an understanding of how traders trade, but there are also some indicators you can use to aid you in your analysis and decision making. e are they open at a profit or at a loss. Having access to information like this can make analyzing the market much easier, because instead of having to guess where things like orders are located in the market, you can just use the indicators to find them out for you, forex market order flow.

These indicators will not only make it easier for you to predict when a large reversal might be about to take place in the market, but will also give you important information about where traders have got their orders placed, which will help you anticipate where and when stop loss hunts may occur, forex market order flow.

Lets start by taking a look at what I think is the best order flow trading indicator you can use in the market. Information forex market order flow what percentage of traders have currently got trades open in the market, and the prices at forex market order flow these trades have been placed, can all be discovered from reading the two graphs the order book shows.

To the left you can see a small image of what the Order Book tool looks like. The Open Positions graph shows you information about the Oanda traders who currently have trades open in the market, forex market order flow.

It gives you an idea of the prices at which these trades have been placed, the amount of traders who have got trades placed at these prices, and whether the trades are currently open at a profit or loss. The Open Orders graph you can see to the left of the image gives y0u information on all the orders Oanda traders currently have open in the market.

An open order is an order which has not yet been executed by the market. It may be an order to have a buy or sell trade placed at a specific price, or it could be a stop loss or take profit order placed by someone who has already got a trade open. Oanda never actually specifies which orders the graph shows, but by understanding how retail traders trade, you can determine that the blue bars represent the stop loss orders placed by traders who already have trades open in the market.

These insights will make it easier for you to predict when orders are going to forex market order flow the market, which in turn will help you determine when and where the price is likely going to move, forex market order flow. Oanda Order Book. The Historical Positions Ratio is an indicator which allows you to see what percentage of Oanda traders had long and short trades open at a point in the past. For example, using the indicators graph I could go back and see what percentage of Oanda traders had long trades open at the end of last Friday.

This information on its own is not that useful, but the fact that the Positions Ratio allows you forex market order flow see how the percentage of open positions have changed overtime, means you can use it to spot when an overly large number of traders have got long or short trades open in the market, giving you an idea of when a large reversal might be about to take place.

The black line you can see running through the graph shows you what the market price was over X number of days. Now you can also see that there two different sections of the graph, one colored blue and one colored orange.

The blue section shows the percentage of buy trades Oanda traders had open at that time in the market, and the orange section shows how many short trades they had open. The best way to see how many traders had trades open is move your cursor over the black line market price line itself.

When you move your cursor over the line a small box will appear, and show you what percentage of Oanda traders forex market order flow long and short at that time in the market. This image shows what the percentage of open positions was on June 29th The fact that the number of traders with open long trades is increasing the further the market falls, tells you that traders are becoming more and more certain the market is soon going to reverse, which is what ends up doing a couple of days later on July 11th.

The majority actually end up closing their buy trade at a loss, because when they initially got their buy trade placed the market was falling, and it continued to fall for a significant length of time after their trade had been executed. Which means by the time the market reverses, most of the traders with long trades open have already spent an extended amount of time holding onto a losing trade.

Holding onto a losing trade is a psychologically demanding experience. For them, the pain of having to potentially endure another draw down is just too much to bear, especially after the reversal itself has caused the size of the loss on their losing trades to decreased dramatically depending on where they actually got their trade placed. It may not be as useful of an indicator as the order book we just looked at, but it does still contain important insights about the market which can help you with your trading.

The only advice I can give you a the moment, is to watch for signs of a reversal taking place when there is an extreme percentage of traders with forex market order flow or short trades open in the market. Historical Open Positions Ratio. Instead of showing you what percentage of traders had buy or sell trades open in the past, it shows you the prices at which they had placed their buy and sell orders at in the past and the presentand also gives you an idea of how many buy and sell orders had been forex market order flow at a particular price in the market.

You can see that there are four graphs in total. The two which you need to be concentrating on are the two seen at the top, titled Buy Orders and Sell Orders. These two graphs show you where all the buy and sell orders have currently been placed in the market and where they have been placed in the past.

The gradient of the color you can see on each graph gives you an indication of amount of orders that was placed at that price. The deep red forex market order flow you can see in the sell orders graph, indicates that a high percentage of sell orders had been placed around this point, whilst the deep green colour you can see in the buy orders graph shows you where a large number forex market order flow buy orders had been placed.

Something which I have found the indicator to be pretty useful for, is finding out the big round number prices which have a high probability of causing the market to reverse. In one of my articles on support and resistance levelsI mention how large reversals usually tend to begin near big round number prices, as traders tend to put their orders around these prices to enter trades and set stop losses.

With these graphs, you can now easily forex market order flow which of the big round number prices hold the highest concentration of orders, allowing you to find the prices that have a high probability of causing the market to reverse. Historical Open Orders Graph, forex market order flow.

I will be doing some articles in the near future on the Historical Open Orders and Open Positions indicators to show you how to better use them, forex market order flow, so check the site in a few weeks time to see if their complete. Save my name, email, and website in this browser for the next time I comment, forex market order flow. Additional menu Home Strategies Technical Analysis Blog Forex Live Rates The goal of an order flow trader is to make predictions about the future market price by thinking about how and when orders are going to come into the market from traders making decisions.

Oanda Order Book 2. If you want to check out the Historical Open Orders Graph for yourself use the link below. Historical Open Orders Graph Summary I will be doing some articles in the near future on the Historical Open Orders and Open Positions indicators to show you how to better use them, so check the site in a few weeks time to see if their complete. Comments Good point, keep going to research, I will continue to follow this article.

Leave a Reply Cancel reply Your email address will not be published. Comment Name Email Save my name, email, and website in this browser for the next time I comment.

Trading Order Flow: Keeping It Simple, Practical \u0026 Effective

, time: 1:04:44The Three Best Order Flow Indicators For Forex Traders

/10/31 · For doing a correct order flow analysis of the forex markets you have to use the real stock exchange data. Volumen and order flow which is provided by Forex Brokers is useless because it is depending on the liquidity provider. By using the volume of futures you get real data that is moving the markets /12/29 · Welcome to the Trading Institutional Order Flow thread. Please read the Rules below. 1. THE METHODOLOGY BEING REPRESENTED HERE MUST BE BASED ON SUPPLY AND DEMAND ONLY. 2. All interactions between traders here must be polite and Order Flow Trading Strategy for Forex and Stock Markets – With PDF Download. Price in the Forex and stock markets moves because of the imbalance of supply and demand. This imbalance is the order flow of buyers and sellers entering and leaving the markets and jostling for the best prices. If you can learn to understand where these imbalances are in

No comments:

Post a Comment