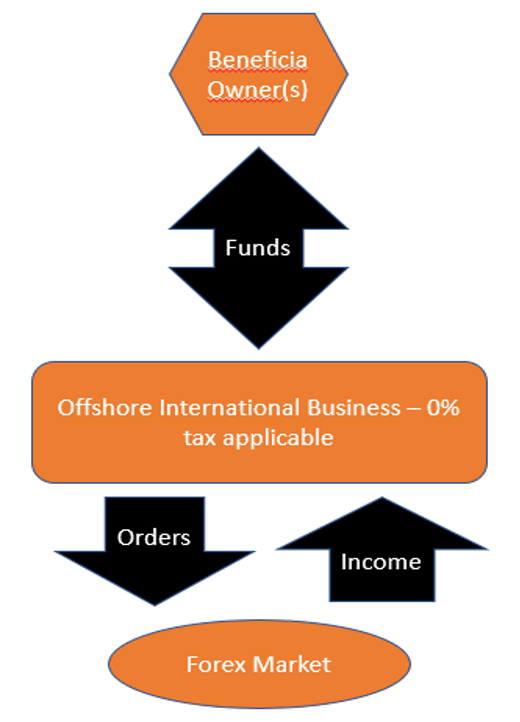

Forex and Commodity Trading are activities which lend themselves well to Offshore Corporate Structuring. For details on how you can minimise tax on trading profits using an Offshore Company as your trading vehicle please take a look at this page from our website: blogger.com Using an offshore company for your forex trades can give you access to a much wider variety of foreign brokers and accounts with significantly better trading terms and conditions. The difficulty is that many foreign brokers are reluctant to accept an offshore company as a client if its director, shareholder, or even beneficial owner is a US citizen Trading forex using an Offshore Company Currency trading is one the most popular activities for Offshore companies What seems to work for most is you set up an International Business Company (“IBC”), in a country that does not require details of shareholders/s owners of the company to be publicly filed, with a Corporate “Nominee” Director and Shareholder as part of the structure

Experience with Offshore Company for Trading Forex - Forex Forum - blogger.com

Are you a security or forex trader? If so, did you know that setting up an offshore company for your trading activities can offer you plenty of benefits, including those that can improve your privacy, forex trading offshore company, management and profitability? Feeling intrigued? Read on. If you are a budding trader, you might be interested in knowing that many traders form an offshore company and open an offshore business account for their trading purposes.

They trade with their company name. With that said, whether you are a new or established trader, you need to consider setting up a company; not any kinds of company, though — I'm talking about offshore company.

But why? Firstly, you may put your privacy at risk, as now people may know you that you are trading for such a large amount. While this is not a problem with some, the issue of privacy is impacting many forex trading offshore company. An offshore company — at the right jurisdiction can offer you the privacy you want. An additional perk: You are free from reporting requirements. As your trading volume and profits grow, forex trading offshore company, you may pay too much for your taxes as an individual entity.

Typically, individuals are taxed more than businesses — so, it's only logical to move your trading activities into a more advantageous entity. With an offshore company, your tax benefits are doubled : Offshore jurisdictions are typically having lower taxes no taxes for most than the non-offshore counterparts.

Trading as a company is perceived to be more trusted and respectable compared to trading as an individual. Chances are, you are perceived as a seasoned or expert trader because you have evolved from individual-level trading to corporate-level trading. Trading individually means that you are putting your personal assets at risk.

Separating your personal account and business account means that the risks of your trading activities are assumed by your business, instead of you personally. You are trading using a trading platform, and you need the service of a broker. Your broker will require first-time traders to fill out forms and prepare the requirements, such as copies of ID, bank statements, forex trading offshore company, address confirmation and so on. All of those mean more hassle and more costs to you.

In addition, you may actually do something illegal when you trade forex in your local jurisdiction. With an offshore company and bank account, you can trade forex any time in any way you want. Not stopping there, some offshore banks even offer you many trading servicesforex trading offshore company, including brokerage service. An offshore bank located in Puerto Ricofor example, enables clients to trade directly with the bank, instead of going through a broker.

Using MT4 Metatrader 4 FX brokerage platform, you may trade online from any parts of the world, as well as managing your Puerto Rico-based bank account right from your laptop or smartphone.

Choosing the right jurisdiction for your trading purposes requires you to do your due diligence. You want to enjoy the perks of an offshore company can offer you legally, and in pursuing it, you often need help from those who have deep knowledge of rules and regulations concerning offshore business operations.

Having experiences with traders, at ICO Services we can advise you on the best suitable jurisdiction. Contact us and drop all your questions! We can help, consult with us. Read also " Can I Buy Assets With my Offshore Company? Table of Contents Setting up an offshore company is your next logical step Privacy Business taxes are forex trading offshore company than personal taxes — offshore taxes are even better Build and enhance your brand image Separate your personal account and business account Forex trading offshore company and Convenience Takeaway.

Day Trading With Offshore Brokers!

, time: 6:035 Reasons Forex and Security Traders Need to Set Up an offshore Company

Using an offshore company for your forex trades can give you access to a much wider variety of foreign brokers and accounts with significantly better trading terms and conditions. The difficulty is that many foreign brokers are reluctant to accept an offshore company as a client if its director, shareholder, or even beneficial owner is a US citizen Trading forex using an Offshore Company Currency trading is one the most popular activities for Offshore companies What seems to work for most is you set up an International Business Company (“IBC”), in a country that does not require details of shareholders/s owners of the company to be publicly filed, with a Corporate “Nominee” Director and Shareholder as part of the structure Forex and Commodity Trading are activities which lend themselves well to Offshore Corporate Structuring. For details on how you can minimise tax on trading profits using an Offshore Company as your trading vehicle please take a look at this page from our website: blogger.com

No comments:

Post a Comment