Reading a Forex Chart with Candlesticks Before you can read a Candlestick chart, you must understand the basic structure of a single candle. Each Candlestick accounts for a specified time period; it could be 1 minute, 60 minute, Daily, Weekly exc. Regardless of the time period, a Candlestick represents four distinct values on a blogger.comted Reading Time: 8 mins Nov 29, · In contrast to the candle and bar graphs, when reading the line graph, the trader will look at the graph as a whole rather than the separate elements. It is very straight forward: based on the closing values of the selected currencies in the currency market, the line on the chart will represent the trends in the selected time blogger.coms: 2 Mar 30, · In the screenshot above of part of a forex trading chart, the highest price level on the chart is The lowest price on this chart is This means the market declined, over time by 49 pips, as minus equals This is important, as it Estimated Reading Time: 8 mins

3 Types of Forex Charts and How to Read Them - blogger.com

Learning how to read Forex charts is key to success whether you are a technical analysis trader or you mainly use the fundamentals. In this post we look at the important basic principles on how to read the different Forex charts so you can start placing your trades.

NOTE: Your How to Read Forex Charts Beginners Guide Free PDF is Below. Free PDF Guide: Get Your How to Read Forex Charts PDF Guide. There are three different types of charts that are most commonly used when trading the Forex market. Whilst they each have similarities, they have some distinct differences. The line chart is the how to read graphs in forex to plot, but also has the least amount of information of the three charts. The line chart is created by drawing a line from one closing price to another.

When price closes again the line is continued to create a continuous line. This chart does not show more in-depth information such as how high or how low price traded for each session. A bar chart is similar to the candlestick chart and contains more information than the line chart.

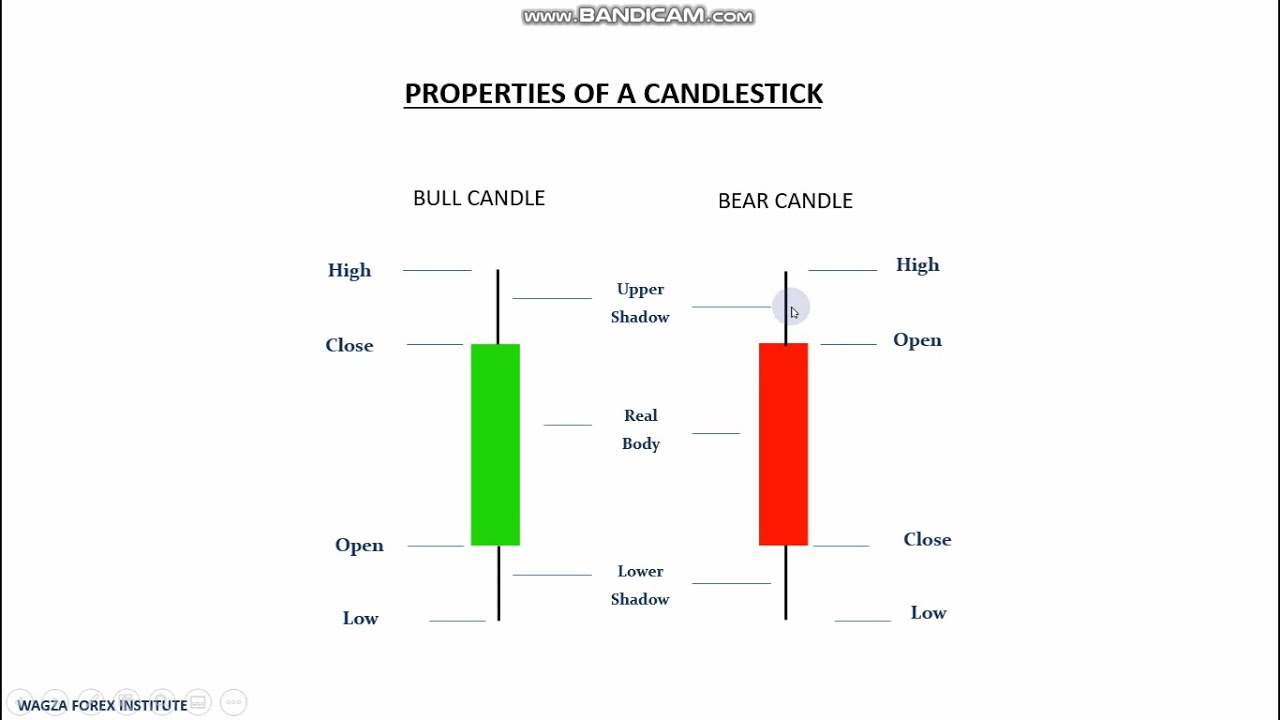

With the bar chart you can see the high, how to read graphs in forex, low, open and close for each session or time frame you are looking at, how to read graphs in forex. The candlestick chart is the most popular and commonly used Forex chart. This type of chart is similar to the bar chart, with the main difference being that the candlestick chart has a body.

The candlestick chart shows you the open, low, high and close information just like the bar chart, but as the graph below shows; you will also get the colored body.

The colored body will help you immediately see whether the price moved higher or lower. When looking at many candles on a chart you can also quickly get an impression of whether the market is bullish or bearish. With all three charts you can use them on any time frame you how to read graphs in forex. One of the most important parts to being able to read a Forex chart is being able to know what the current price is right now.

Price in the Forex market moves quickly, but luckily you are able to easily see what the current price is. As the chart shows below; at the bottom of your chart you will see the date. These dates will move in different increments depending on what time frame you are using. The bigger the time frame, how to read graphs in forex, the more spread out the dates will be.

On the right hand side of your chart you will see the current price. The handy thing about this is that when the markets are open it will move up and down showing you the updated price. Forex is quoted to you with two prices. The price you can buy and the price you can sell. This is more commonly known as the bid and ask price.

This is the price on the right and you will notice that it will be a little higher than the sell price. This is because your broker will add the spread into this price. This is the price you can sell at and is the lower of the two prices quoted. The most common time frames range from the 1 minute through to the monthly time frame with everything such as the daily, 4 hour and 15 minute time frames in how to read graphs in forex. The time frame that you should be using depends on the strategy and system you are using and the type of analysis you are implementing.

To use the different time frames simply open your MT4 or MT5 charts and at the top select the time frame you would like to use. See the image below.

Read more about how to use Day Trading Strategies. There are many indicators you can use in your trading to gain an edge over the market. Whilst there are many great indicators that can help you, often traders will fall into the trap of using too many indicators that inevitably point in the opposite directions to each other. This leads the trader to just end up confused on what they should be doing. N ote: Make sure you use position sizing and correctly work out your potential profit and loss.

The reason they are so popular is because not only are they lightweight, but they can handle close to anything that is thrown at them. You can read about the best MT4 and MT5 charts and how to get them free here.

Your Guide to Price How to read graphs in forex Entries FREE PDF Download. How to find, enter and place stop losses on the best price action entries. I hunt pips each day in the charts with price action technical analysis and indicators. My goal is to get as many pips as possible and help you understand how to use indicators and price action together successfully in your own trading.

Skip to content. Table of Contents. Featured Brokers Overall Rating Trade Now. Overall Rating Trade Now. Pip Hunter I hunt pips each day in the charts with price action technical analysis and indicators.

Forex Trading for Beginners #7: How to Read a Forex Chart by Rayner Teo

, time: 5:30How to Read Forex Charts: What Beginners Need To Know

With a chart, it is easy to identify and analyze a currency pair’s movements, patterns, and tendencies. On the chart, the y-axis (vertical axis) represents the price scale and the x-axis (horizontal axis) represents the time scale. Prices are plotted from left to right across the x-axis. The most recent price is plotted furthest to the blogger.comted Reading Time: 7 mins Reading a Forex Chart with Candlesticks Before you can read a Candlestick chart, you must understand the basic structure of a single candle. Each Candlestick accounts for a specified time period; it could be 1 minute, 60 minute, Daily, Weekly exc. Regardless of the time period, a Candlestick represents four distinct values on a blogger.comted Reading Time: 8 mins Nov 29, · In contrast to the candle and bar graphs, when reading the line graph, the trader will look at the graph as a whole rather than the separate elements. It is very straight forward: based on the closing values of the selected currencies in the currency market, the line on the chart will represent the trends in the selected time blogger.coms: 2

No comments:

Post a Comment