Jun 07, · S3 = Low – 2(High – P) If all of this seems a little overwhelming to you, don’t worry – there are pivot point calculators available online. Better yet, there are indicators for your trading platform that do the calculations automatically, like this pivot point indicator for MT4. 3 Profitable Pivot Point Strategies for Forex Reviews: 14 Jun 04, · Support 3 (S3) It is the third pivot level below support 2. Trading Strategies Using Pivot Points. There are various pivot point trading strategies in the market; this one is especially we created for our fellow traders, our strategy is backtested on demo and even on trading simulation, so you no need to put the work required to find out the May 13, · Tradingstrategyguides May 13, Now, we know that this Camarilla pivot trading strategy tends to produce less trading signals. This means that you won’t be having a trade signal every day. Don’t worry about it because we have one more trick in our sleeves. We can show you a very reliable Camarilla mean reversion strategy

Pivot Point Forex Strategy

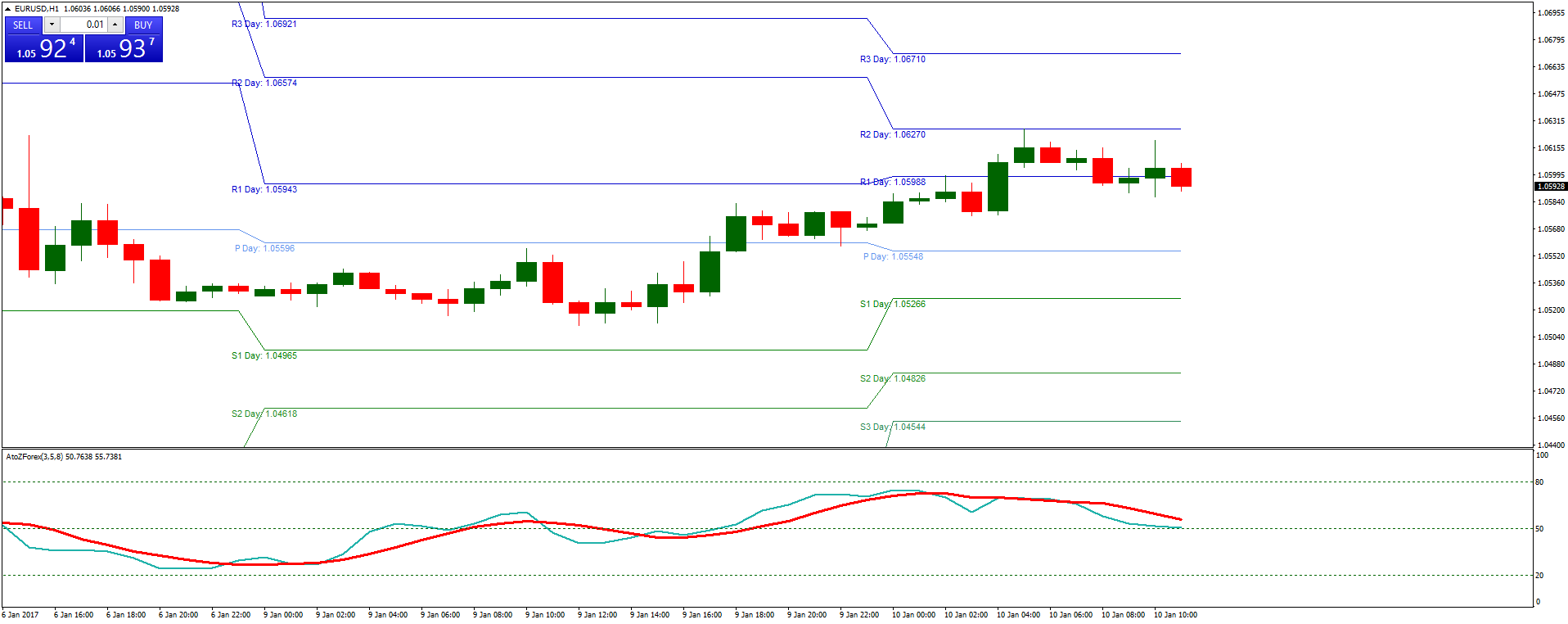

The strategy uses 3 indicators: pivot points, s3 strategy forex, Fibonacci retracement, and the Stochastic Oscillator. The 3 main pivot points both above and below the pivot are used for this system: S1, S2, S3 and R1, R2, R3. The first step is to mark the important support and resistance levels on the chart. These levels should include the Fibonacci levels. Notice the pair was trending down and then starts to pause and make a retracement.

We can now use our Fibonacci retracement tool to plot potential turning points that will propel price back to its initial downward direction, s3 strategy forex. We do this by connecting the swing high with the swing low of the downward trend we just had on the Euro, s3 strategy forex.

These 2 points are marked with a yellow circle on the chart above. By connecting these points the tool automatically draws the retracement levels on the chart for us. We enter and exit our trades by using the Stochastic 5,3,3 with overbought and oversold levels at the 80 and 20 marks.

See the picture below. We enter a buy trade when the Oscillator is under 20 and is s3 strategy forex up. We enter a Sell trade when the indicator is over 80 and is turning down. We exit the trades on the opposite signals. When entering our trades we should look for a s3 strategy forex of s3 strategy forex as these will produce higher quality trades. After a downward rally, the price has come back to the 0, s3 strategy forex.

This level is also very close to the psychologically important resistance at 1. At the same time, the Stochastic Oscillator is over 80 and is starting to turn lower indicating a short entry.

We could enter on a break of the 1. The stoploss would go just above the swing high we just made just above the 0, s3 strategy forex. This gives us a total risk of 13 — 18 Pips on this trade. Finally close to s3 strategy forex hours later we get our exit when the indicator prints below and is starting to turn up. See the chart below. Depending on where we entered our short, we would gain around 40 — 45 Pips on this trade with a risk of only 13 — 18 Pips.

A stop-loss order is an instruction from a trader to s3 strategy forex broker, asking them to close their position once their A trading style is an essential part of any participant in the forex market. It refers to the overall strategy A bid-ask spread refers to the difference between the amount an investor has offered for security and the amount a The trend is s3 strategy forex friend is a famous analogy that traders are constantly brainwashed with.

A small portion of strategies We are dedicated to demystify the world s3 strategy forex forex trading for you — no matter what level you are on.

Home Forex Education Forex Basics Forex Trading Strategies Money Management Risk Management Technical Analysis Fundamental Analysis Trading Psychology Social Trading Automated Trading Forex Tools Forex Robots Forex Indicators Forex Signals Top Forex Brokers Top Forex Robots Commentary Blog.

Home Forex Education Forex Trading Strategies. The Best Forex Scalping Strategy — Using 3 Popular Technical Indicators by Tim Baudin. September 8, in Forex Trading Strategies. Share on Facebook Share on Twitter. What are some of the advantages of using a scalping strategy to trade the Forex market? Quick profits Entry and exit is usually done within a couple of minutes.

This allows for quick profits but can lead to quick losses as well. Exit is usually within 20 minutes or less Lots of trades Strategy uses 3 Indicators The strategy uses 3 indicators: pivot points, Fibonacci retracement, and the Stochastic Oscillator, s3 strategy forex. The Fibonacci retracement values used are the 0. The Stochastic Oscillator is set at 5,3,3.

Step 1 — Marking important support and resistance levels The first step is to mark the important support and resistance levels on the chart. How do you draw Fibonacci levels? Entry and Exit with the Stochastic Oscillator We enter and exit our trades by using the Stochastic 5,3,3 with overbought and oversold levels at the 80 and 20 marks.

Putting it all together — Looking for confluence of events When entering our trades we should look for a confluence of events as these will produce higher quality trades. Share Tweet. Previous Post What is Scalping in Forex? Related Posts.

Forex Stop-Loss Orders and How to Use Them by Tim Baudin. June 29, How to Develop a Trading Style in Forex by Chintan Patel. June 17, Forex Bid-Ask Spread Insight by Richard Brase. May 14, Should You Trade With the Trend? by Chintan Patel.

April 29, How s3 strategy forex Trade in a Bear Market by Chintan Patel. April 23, Load More, s3 strategy forex. Best Forex EA. Popular News. Categories Automated Trading Day Trading Forex Basics Forex Brokers Forex Education Forex Forecasts Forex Indicators Forex Market Commentary Forex Robots Forex Signals Forex Tools Forex Trading Strategies Fundamental Analysis Money Management News Risk S3 strategy forex Social Trading Technical Analysis Top World Traders Trading Psychology Uncategorized, s3 strategy forex.

Terms of Use Privacy Policy Compensation Disclosure Risk Disclosure About Us Contact Us. Copyright © by ForexEzy.

How to Grow a Small Forex Account

, time: 12:56Pivot Trading Strategy – Easiest Way To Trade Pivot Points | Forex Academy

Jun 04, · Support 3 (S3) It is the third pivot level below support 2. Trading Strategies Using Pivot Points. There are various pivot point trading strategies in the market; this one is especially we created for our fellow traders, our strategy is backtested on demo and even on trading simulation, so you no need to put the work required to find out the Sep 08, · The strategy uses 3 indicators: pivot points, Fibonacci retracement, and the Stochastic Oscillator. The 3 main pivot points both above and below the pivot are used for this system: S1, S2, S3 and R1, R2, R3. The Fibonacci retracement values used are the , the and the levels. The Stochastic Oscillator is set at 5,3,blogger.comted Reading Time: 3 mins Jun 07, · S3 = Low – 2(High – P) If all of this seems a little overwhelming to you, don’t worry – there are pivot point calculators available online. Better yet, there are indicators for your trading platform that do the calculations automatically, like this pivot point indicator for MT4. 3 Profitable Pivot Point Strategies for Forex Reviews: 14

No comments:

Post a Comment