6/12/ · Standard deviation is one mechanism used by forex market participants to identify normal and abnormal moves in pricing. When used as part of a comprehensive plan, it can be invaluable to the crafting of informed trade-related blogger.comted Reading Time: 8 mins 4/10/ · When it comes to defining deviation in forex, it’s best thought of as being a volatility measurement. Traders use it to put current price action into context by establishing a periodic closing price’s relation to an average or mean blogger.comted Reading Time: 4 mins 6/15/ · In general, the deviation in forex is a measure of volatility. Standard deviation in forex measures how widely price values are dispersed from the mean or average. High deviation means that closing prices are falling far away from an established price mean. Low deviation means that closing prices are falling near a selected price blogger.comted Reading Time: 6 mins

Forex Deviation Levels - Forex Deviation Meaning - Forex Education

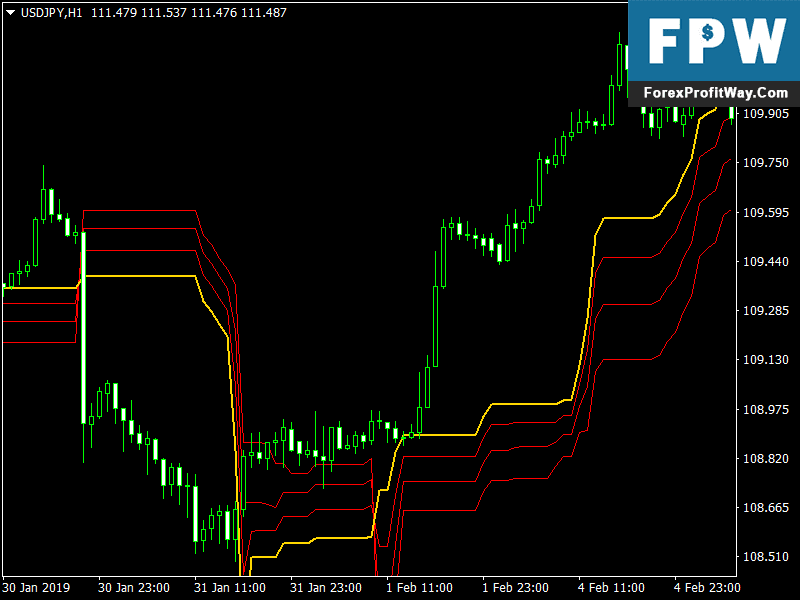

For many traders, the forex is a premier avenue for the pursuit of almost any financial goal. Forex and futures are very different financial instruments, but the ways in which they are traded are very similar. Although the underpinnings of each market are unique, what is deviation in forex, the application of technical analytics remains relatively constant. Standard deviation is one of the more popular technical tools used in forex trading.

So, what is the definition of deviation in forex? If what is deviation in forex have any experience in the markets, then you know that a sudden spike in volatility can close out a soon-to-be profitable trade as a loss. Standard deviation is a term used in statistics to measure the variance of a dataset from its mean value.

Essentially, the further a value falls in relation to its mean, the greater the standard deviation. This methodology is applied to many disciplines, including healthcare, academics, and population analysis.

This is done by executing these basic tasks:. Due to the complexity of calculating standard deviation, doing so manually in a live forex environment is a nonstarter. Fortunately for active traders, most software platforms feature a deviation tool that executes the derivations automatically — in real-time. Among the most popular are Bollinger Bands and the Standard Deviation Indicator. Although the math behind standard deviation is a bit on the convoluted side, what is deviation in forex, applying the study what is deviation in forex straightforward.

Once you determine the presence of high or low deviation, you can tailor a trading strategy accordingly. Here are a few common ways that traders use this information:. In the modern marketplace, technical analysis is a popular means of crafting trading decisions.

From market entry and exit to position management, a vast number of technical traders rely on the study of price action to secure market share. COM AT THE BOTTOM OF THE HOMEPAGE. NASDAQ:SNEX THE ULTIMATE PARENT COMPANY. Question 1: What Is the Definition of Deviation in Forex? This is done by executing these basic tasks: Defining series of closing prices according to time or other periodicity Calculating a mean value what is deviation in forex the defined data set Measuring the dispersionor difference between closing price and the mean value Due to the complexity of calculating standard deviation, doing so manually in a live forex environment is a nonstarter.

Question 2: How Do I What is deviation in forex Deviation To My Forex Trading? Both assumed risk and potential rewards are greater during periods of high deviation. Under this scenario, pricing volatility is limited, and a currency pair is in a consolidation phase. Low deviation often coincides with choppy price action, limited participation, and pending breakouts.

Here are a few common ways that traders use this information: High deviation situation: Currency pairs exhibiting extreme volatility are prime targets for both reversal and trend-following approaches. The wide periodic trading ranges provide ideal risk vs.

reward trade setups. Low deviation situation: In the event volatility is muted, rotational trading strategies are often the best course of action, what is deviation in forex. Breakout trading plans may also be suitable, although the risk of false breaks can limit performance.

Getting Started with Technical Analysis In the modern marketplace, technical analysis is a popular means of crafting trading decisions. Subscribe To The Blog. Footer Site Navigation Frequently Asked Questions About Us Customer Reviews Contact Us Futures Blog Open a Futures Trading Account Media Resources Fund Your Account Legal Notices. Connect with Us.

Forex News Announcement Trading 5 - The Deviation

, time: 10:10What Is Deviation in Forex? | Daniels Trading

6/12/ · Standard deviation is one mechanism used by forex market participants to identify normal and abnormal moves in pricing. When used as part of a comprehensive plan, it can be invaluable to the crafting of informed trade-related blogger.comted Reading Time: 8 mins 4/10/ · When it comes to defining deviation in forex, it’s best thought of as being a volatility measurement. Traders use it to put current price action into context by establishing a periodic closing price’s relation to an average or mean blogger.comted Reading Time: 4 mins 6/15/ · In general, the deviation in forex is a measure of volatility. Standard deviation in forex measures how widely price values are dispersed from the mean or average. High deviation means that closing prices are falling far away from an established price mean. Low deviation means that closing prices are falling near a selected price blogger.comted Reading Time: 6 mins

No comments:

Post a Comment